|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Who Has the Best Refinance Rates in Today's Market?Refinancing your home can be a smart financial move, but finding the best refinance rates is crucial. This guide explores different lenders and offers insights into securing the best rates available today. Understanding Refinance RatesRefinance rates vary based on several factors including market conditions, your credit score, and the equity in your home. Factors Influencing Refinance Rates

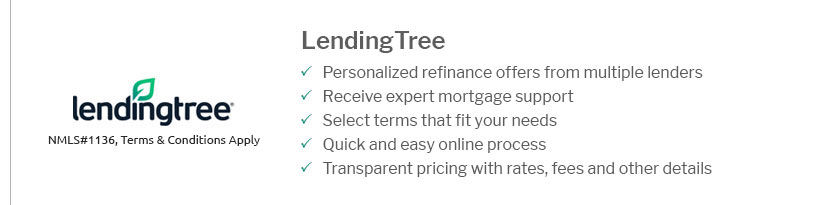

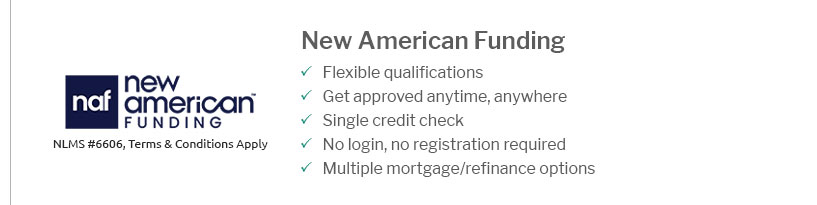

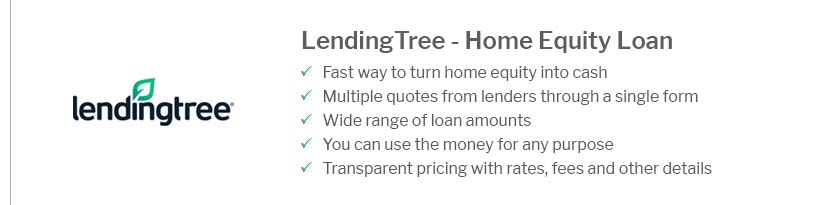

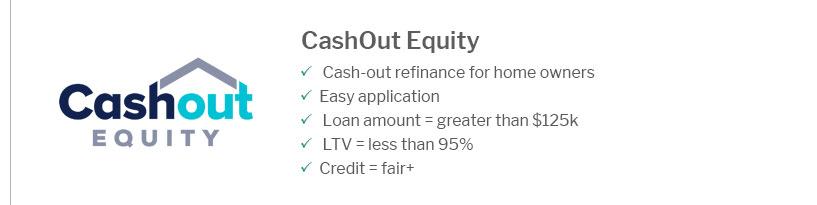

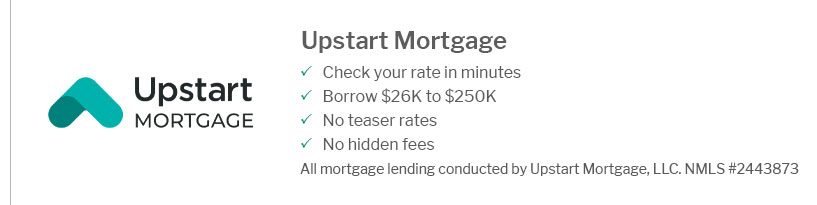

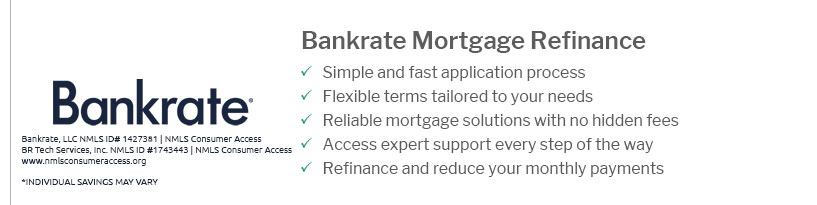

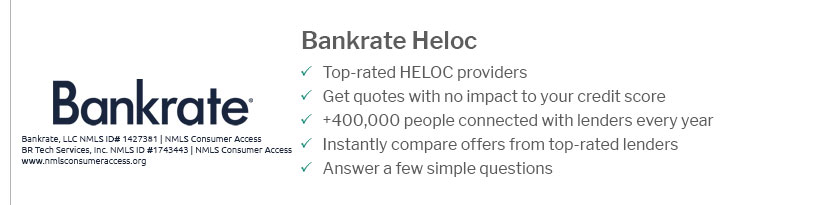

Understanding these factors can help you negotiate better terms when refinancing your home. Top Lenders for Refinance RatesSeveral lenders consistently offer competitive rates, but it's important to shop around and compare options. Noteworthy Lenders

Each lender has unique offerings, so consider your personal financial situation when choosing. Steps to Secure the Best Refinance RatesTo obtain the best refinance rates, follow these steps:

Additionally, understanding the average cost to refinance home loan can help you budget for the refinancing process. FAQs About Refinance RatesWhat is a good refinance rate?A good refinance rate is typically lower than your current mortgage rate. Rates vary, so compare offers from multiple lenders. How often do refinance rates change?Refinance rates can change daily based on market conditions. Staying updated with rate trends is advisable when considering refinancing. Are there any hidden costs associated with refinancing?Yes, refinancing can include costs such as closing fees. It's important to consider the average home refinance closing costs when calculating potential savings. In conclusion, finding the best refinance rates involves research, understanding key factors, and comparing offers from various lenders. By following these steps, you can potentially lower your monthly payments and save money over the life of your loan. https://smartasset.com/refinance/refinance-mortgage-rates

That means applying for the mortgage (and having the credit score to quality for a low rate), dealing with paperwork and paying closing costs and other fees. https://www.bankofamerica.com/mortgage/refinance-rates/

Today's competitive refinance rates ; 30-year - 7.125% - 7.320% ; 20-year - 7.125% - 7.342% ; 15-year - 6.250% - 6.534% ; 10y/6m - 7.000% - 7.246% ; 7y/6m - 7.000% - 7.257%. https://better.com/refinance-rates

Refinance rates - 30-yr fixed. Rate. 6.750%. APR. 6.954%. Points (cost). 2.06 ($3,291). Term. 30-yr fixed. Rate - 30-yr fixed FHA. Rate. 6.250%. APR. 6.453% ...

|

|---|